NUBURU, Inc. Announces Full Year 2022 Financial Results for Tailwind Acquisition Corp.

CENTENNIAL, Colo. – March 8, 2023 – NUBURU Inc. (“NUBURU” or the “Company”) (NYSE American: BURU), a leading innovator in high-power and high-brightness industrial blue laser technology, today announced the financial results for the fiscal year ended December 31, 2022 for the Company, which was then known as Tailwind Acquisition Corp. (“Tailwind”), a special purpose acquisition company.

As previously announced on January 31, 2023, Tailwind and the company then known as NUBURU, Inc. completed their business combination (the “Business Combination”). Following the Business Combination the combined company operates and will disclose its financial results under the “NUBURU, Inc.” name.

Full Year Financial Highlights (Unaudited)

- Net income of $11.1 million for the year ended December 31, 2022 compared to $17.8 million for the year ended December 31, 2021. The reduction in net income is primarily attributed to the year over year decline in fair value of warrant liabilities which was partially offset by the narrowed loss from operations.

- Cash and marketable securities held in Trust Account of $33.0 million as of December 31, 2022 compared to $334.4 million as of December 31, 2021. The reduction in cash and marketable securities held in Trust Account is due to the redemption of 30.2 million shares of Class A common stock for cash at a redemption price of approximately $10.03 per share during the year.

TAILWIND ACQUISITION CORP.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

|

|

December 31, |

|

|||||

|

|

|

2022 |

|

|

2021 |

|

||

|

ASSETS |

|

|

|

|

|

|

||

|

Current Assets |

|

|

|

|

|

|

||

|

Cash |

|

$ |

4,749 |

|

|

$ |

479,694 |

|

|

Prepaid

expenses |

|

|

80,875 |

|

|

|

111,667 |

|

|

Total Current

Assets |

|

|

85,624 |

|

|

|

591,361 |

|

|

|

|

|

|

|

|

|

||

|

Cash and

marketable securities held in Trust Account |

|

|

33,034,062 |

|

|

|

334,441,194 |

|

|

TOTAL ASSETS |

|

$ |

33,119,686 |

|

|

$ |

335,032,555 |

|

|

|

|

|

|

|

|

|

||

|

LIABILITIES, CLASS A STOCK SUBJECT TO POSSIBLE REDEMPTION AND

STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

||

|

Current

liabilities |

|

|

|

|

|

|

||

|

Accounts

payable and accrued expenses |

|

$ |

4,992,362 |

|

|

$ |

3,867,106 |

|

|

Accrued

offering costs |

|

― |

|

|

|

109,000 |

|

|

|

Income taxes

payable |

|

|

88,204 |

|

|

― |

|

|

|

Class A common

stock redemption payable |

|

|

29,554,443 |

|

|

― |

|

|

|

Total Current

Liabilities |

|

|

34,635,009 |

|

|

|

3,976,106 |

|

|

|

|

|

|

|

|

|

||

|

Convertible

note - related party |

|

|

600,000 |

|

|

― |

|

|

|

Warrant

liabilities |

|

|

1,848,755 |

|

|

|

13,733,608 |

|

|

Deferred

underwriting fee payable |

|

|

11,697,550 |

|

|

|

11,697,550 |

|

|

Total Liabilities |

|

|

48,781,314 |

|

|

|

29,407,264 |

|

|

|

|

|

|

|

|

|

||

|

Commitments and Contingencies |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

Class A common

stock subject to possible redemption; 500,000,000 shares authorized, 316,188

and 33,421,570 shares issued and outstanding at $10.13 and $10.00 per share

as of December 31, 2022 and 2021; 2,916,653 shares redeemed but unpaid as of

December 31, 2022 |

|

|

3,203,933 |

|

|

|

334,215,700 |

|

|

|

|

|

|

|

|

|

||

|

Stockholders’ Deficit |

|

|

|

|

|

|

||

|

Preferred

Stock, $0.0001 par value; 1,000,000 shares authorized; none issued and

outstanding |

|

|

— |

|

|

|

— |

|

|

Class A common

stock, $0.0001 par value; 500,000,000 shares authorized; no shares issued and

outstanding (excluding 3,232,841 and 33,421,570 shares subject to possible

redemption) as of December 31, 2022 and 2021, respectively |

|

|

— |

|

|

|

— |

|

|

Class B common

stock, $0.0001 par value; 50,000,000 shares authorized; and 8,355,393 shares

issued and outstanding as of December 31, 2022 and 2021 |

|

|

836 |

|

|

|

836 |

|

|

Accumulated

deficit |

|

|

(18,866,397 |

) |

|

|

(28,591,245 |

) |

|

Total Stockholders’ Deficit |

|

|

(18,865,561 |

) |

|

|

(28,590,409 |

) |

|

TOTAL

LIABILITIES, CLASS A STOCK SUBJECT TO POSSIBLE REDEMPTION AND STOCKHOLDERS’

DEFICIT |

|

$ |

33,119,686 |

|

|

$ |

335,032,555 |

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

For the Year Ended

December 31, |

|

|

For the Period

from May 29, 2020 (inception) through December 31, |

|

||||||

|

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|||

|

Formation and

operational costs |

|

$ |

1,958,641 |

|

|

$ |

5,572,066 |

|

|

$ |

387,335 |

|

|

Loss from operations |

|

|

(1,958,641 |

) |

|

|

(5,572,066 |

) |

|

|

(387,335 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Other income

(expense): |

|

|

|

|

|

|

|

|

|

|||

|

Interest earned

on marketable securities held in Trust Account |

|

|

1,573,401 |

|

|

|

120,063 |

|

|

|

105,431 |

|

|

Transaction

costs associated with the Initial Public Offering |

|

|

— |

|

|

|

— |

|

|

|

(715,720 |

) |

|

Change in fair

value of warrant liabilities |

|

|

11,884,853 |

|

|

|

23,241,491 |

|

|

|

(16,902,902 |

) |

|

Total other

income (expense), net |

|

|

13,458,254 |

|

|

|

23,361,554 |

|

|

|

(17,513,191 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Income before

provision for income taxes |

|

|

11,499,613 |

|

|

|

17,789,488 |

|

|

|

(17,900,526 |

) |

|

Provision for

income taxes |

|

|

(358,204 |

) |

|

|

— |

|

|

|

— |

|

|

Net income (loss) |

|

$ |

11,141,409 |

|

|

$ |

17,789,488 |

|

|

$ |

(17,900,526 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Weighted

average shares outstanding, Class A common stock |

|

|

24,075,470 |

|

|

|

33,421,570 |

|

|

|

18,333,191 |

|

|

Basic and diluted income (loss) per share, Class A common stock |

|

$ |

0.34 |

|

|

$ |

0.43 |

|

|

$ |

(0.68 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

Weighted

average shares outstanding, Class B common stock |

|

|

8,355,393 |

|

|

|

8,355,393 |

|

|

|

7,969,220 |

|

|

Basic

and diluted net income (loss) per share, Class B common stock |

|

$ |

0.34 |

|

|

$ |

0.43 |

|

|

$ |

(0.68 |

) |

About Nuburu

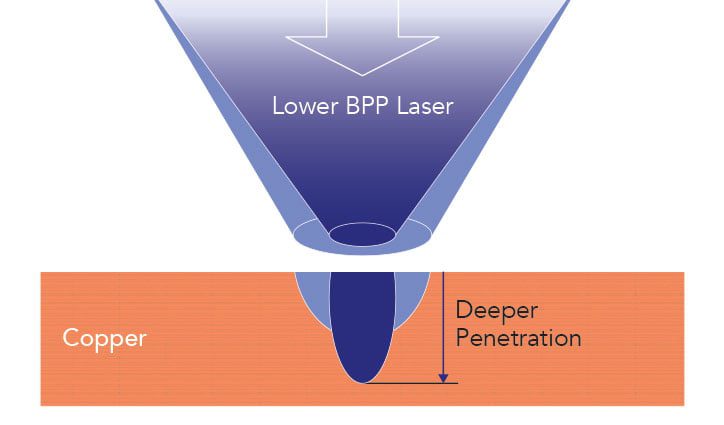

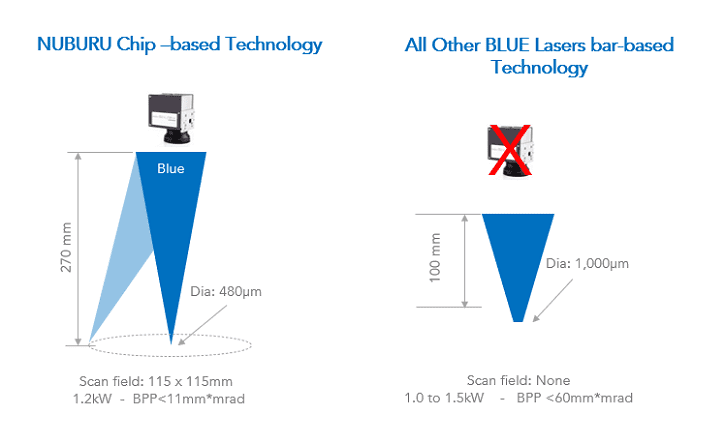

Founded in 2015, NUBURU is a developer and manufacturer of industrial blue lasers that leverage fundamental physics and their high-brightness, high-power design to produce a faster, higher quality laser than currently available alternatives in materials processing, including laser welding and additive manufacturing of copper, gold, aluminum and other industrially important metals. NUBURU’s industrial blue lasers produce minimal to defect-free welds that are up to eight times faster than the traditional approaches — all with the flexibility inherent to laser processing.

Learn more at NUBURU.net.

Contacts

NUBURU – Media Contact

Brian Knaley

ir@nuburu.net

NUBURU – Investor Relations Contact

Maria Hocut

Maria@blueshirtgroup.com